Mobility

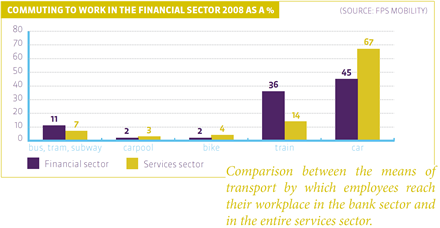

The number of employees that travel to work by tram, train, bus or underground is much higher in the financial sector than in the rest of the services sector. The train is especially frequently used. A strong contributing factor in this regard is probably that each employee is 100% reimbursed for his/her public transport pass(es).. In addition, the headquarters of the largest financial institutions are in the large cities, mainly in Brussels, which are more easily accessible by public transport. This is a development that has become clear especially in the last decade. Before that, a larger proportion of staff was deployed in the regional branches of the financial institutions.

Besides a bicycle bonus for those who come to work by bicycle, various financial institutions also provide (covered) bike parking, repair kits and showers.

Despite these endeavours to encourage employees to leave the car at home as much as possible, the car nevertheless remains the most popular mode of transport. Nevertheless, the percentage of car users is still much lower in the financial sector than outside of it.

The sector is also trying to limit its ecological footprint by promoting “flexible workplaces”. In this system, there are for example 8 workplaces available for 10 employees, or employees can work from home, etc.

Paper and energy

The ecological footprint of the financial sector consists to a great extent of paper and energy consumption. By various measures, the individual institutions are trying to reduce this consumption:

- setting the heating at a lower temperature during the winter and reducing the air conditioning during the summer

- replacement of old, energy-guzzling electric equipment

- installation of water boilers and solar panels

- participation in the Earth Hour of the World Wildlife Fund, during which the lights are switched off for one hour

- printing on sustainable paper (paper with an ECO label of an FSC label, denoting that the paper originates from responsibly managed woods)

- awareness-raising of employees not to print e-mails and, if necessary after all, to print them on both sides of the paper

- etc.

Objectives

For the future, all the financial institutions want to make an extra effort. Some have undertaken ambitious goals for reducing CO2 emissions:

- 13% less energy consumption by 2015 or 20% less by 2020

- a share of 20% renewable energy compared with total energy consumption

- 10% less paper per customer by 2013 (in kilogrammes) or 5% less paper consumption in general

- 20% less greenhouse gases from the institution’s own motorcar fleet

- reduction of the number of business trips

- etc.

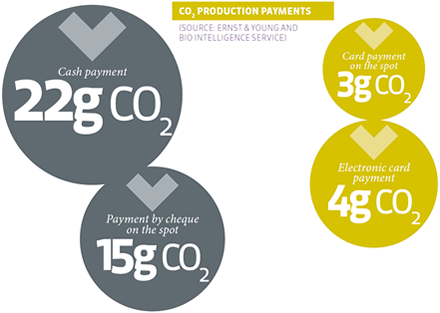

Moreover, the financial sector promotes electronic payment transactions. E-payments have the smallest ecological footprint of all means of payment. An electronic payment using a card, for instance, produces 3 grams of CO2, against no less than 22 grams for a cash payment.