Febelfin has drafted a recommendation for its members stating which financial products may be qualified as sustainable.

Recommendation

The concretisation of the “sustainability” of a specific product is determined to a large extent by the distributor or the promoter of the product. As a result, it is not always clear to the consumer which products are “really” sustainable, all the more so because ‘sustainable’ and ‘ethical’ mean different things to different people. Nuclear energy, tobacco or genetically modified organisms are examples of so-called controversial activities whose funding via a sustainable product is a matter for discussion.

Some minimum norms must be met, therefore. The extensive funding of the weapon industry or of companies that blatantly violate human rights is hard to justify with regard to the social norms. It is of great importance to the consumer to easily and clearly identify if the interpretation given to the sustainability of a product matches his personal vision in this respect. Besides, he will have to be sure that the product he has purchased also effectively, directly or indirectly, supports sustainable objectives.

In that framework, Febelfin has drawn up a recommendation for its members.

Sustainable investment funds

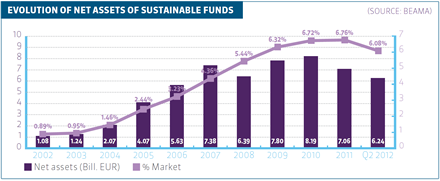

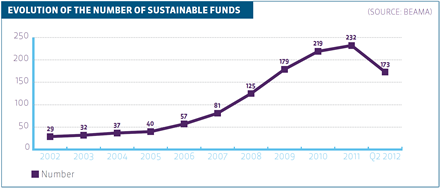

Since 2001, BEAMA, the association for investment products, has been supervising the quality of undertakings for collective investment (UCIs) that invest sustainably and in a socially responsible manner (DMVI). Initially the share of the UCIs in the Belgian market was limited: the sustainable investment funds (DMVI-UCIs) represented 1% of all UCIs commercialised in Belgium. Between 2004 and 2010, the share of the sustainable investment funds increased in the Belgian market to 6.72% at the end of 2010 (i.e. an amount of €8.19 billion). Between 2004 and 2006 especially, a clear rise was noticeable, largely due to the fact that UCIs that satisfied the conditions received the label of sustainable investment fund in that period.

In addition, the managers of sustainable investment funds strongly promoted these products.

In the period between 2007 and 2009, nearly a quarter of the growth could be realised annually thanks to fresh capital invested in funds that were brought on the market in the course of that particular year. In 2009, 54 new sustainable investment funds arrived on the Belgian market for an amount of more than €2 billion.

Sustainable savings products

Currently, the number and volume of sustainable savings products are much smaller than those of the same type of investment funds. At present, there are only some institutions that offer this kind of products. However, sustainable saving may become for more popular in the future thanks to the commitment from a number of institutions and the recent recommendation as for the minimum standard.

Green loans

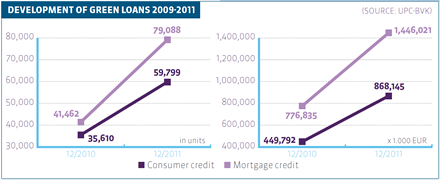

At the end of 2008, the government decided to implement the system of green loans with a view to supporting the Belgian economy and the building sector. The government provided an interest rebate of 1.5%, which meant that it funded 1.5% of the interest on a green loan. As a result, Belgian consumers could make energy-saving investments at an advantageous rate, such as the installation of solar energy panels, roof insulation, double glazing, etc.

In the first few months after the measure took effect the number of green loans with an interest rebate remained limited. In the course of 2010 that number rose strongly, especially because the measure became better known due to the promotion by the lenders.

Between August 2009 and the end of 2010, about 77,000 green loans were granted for a total amount of €1.2 billion. When the announcement was made in 2011 that the measure would not be extended, the number of loans increased considerably: an extra 140,000 loans in 2011, worth €2.3 billion.

With the termination of this governmental measure, the tax benefit of a green loan in personal taxation was cancelled, but the financial sector did not yet stop its contribution to sustainable and socially responsible investments. Most banks, therefore, still offer green loans at an improved rate, whether or not they are partially supported by a governmental subsidy.