Without this funding, economic growth in Belgium would be lower.

Due to the fact that the volume of the financial sector has decreased and specific activities have been phased-out, the sector will especially have to generate added value in the future via the conversion of deposits into loans and via the supply of payment systems. As a result, the added value of the sector will most probably decrease.

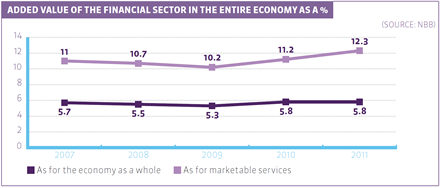

The non-financial sectors have seen their added value in the economy decrease after the financial crisis. In the financial sector this downward movement is not so noticeable. After a slight decrease in 2008 and 2009, the added value has started to go up again.

Theoretically, the concept “added value” in the industrial sector denotes the difference between the market value of a product and the purchasing price of the raw materials. In the financial sector, the added value in accounting is the difference between the revenues from services and interests on loans, on the one hand, and the interest on deposits and funding via the financial markets, on the other hand.

In a broader sense, the added value of the financial sector consists in the extent to which it automatically converts savings into loans that promote economic growth.

In 2011, the added value of the financial sector in the entire economy was 5.8%. The share of the financial sector was even larger if we take the tradable services sector (all commercial services suppliers) as a benchmark.

Since the end of 2007, the financial sector has granted €87.3 billion in additional loans to companies, families and governmental bodies. That means that for each extra euro in savings, an additional euro has been invested in the economy. Research at the KU Leuven showed in 2011 that the funding of the economy by the banks has generated half a per cent of economic growth, or In other words, that the financial sector accounted for one fifth of the total economic growth that took place in Belgium in 2011.

Another important factor when calculating the added value of the financial sector is its number of staff. In 2012, the sector represents 100,000 direct jobs, and indirectly about another 120,000.

It is striking that the gross added value per employee increased between 2007 and 2010 by 23.3% to reach €160,000. This indicates that the sector pays great attention to the improvement of its efficiency. It is no coincidence that since 2008 improvement is noticeable in the relationship between the costs and the income of the sector. The financial crisis and the pressure on profitability has resulted in more efficient use by the financial sector of its resources, which also means that this has sometimes resulted in a decrease in the number of available jobs and greater work pressure.

Significant changes

Due to the significant reforms in the financial landscape since the occurrence of the financial crisis, the sector has decreased in volume, amongst other things as a result of the phasing-out of foreign activities, restructuring, deleveraging, etc.

The share, in commercial trading, of financial products that, before the financial crisis, was important for the profitability of the financial institutions, had dropped by one half after the crisis. A recent survey showed that the share of proprietary trading (trading for one’s own account, an activity through which Belgian banks mainly cover themselves against price fluctuations on the financial markets) in the trading volumes of the banks dropped sharply in the first six months of 2012. In 2009 that share was still 13%. This places Belgian banks far under the European average. The speculative element of proprietary trading, which further reinforced the crisis in 2007 and 2008, is currently hardly present within Belgian financial institutions.

As a result of the significant changes of the last few years, the added value of the sector will have to be based to a larger extent on the transformation function (the conversion of savings into loans) and on the offer of effective payment systems in the coming years. That implies that the added value may become lower than in the past, due to which the pressure on the financial sector and the stability of its various subsectors will increase.