Each year the National Bank of Belgium (NBB) publishes a Financial Stability Review, in which it reports about economic, financial and structural developments that may have an impact on the stability of the financial system. In the 2012 report, the Belgian financial sector received both a compliment and a warning. A compliment because the sector has continued to finance the economy in spite of difficult times, and a warning because the National Bank feared overvaluation of real estate prices. Therefore the NBB urged the Belgian system banks, which are the banks that in the event of bankruptcy could also seriously harm the rest of the economy, to be careful when granting mortgage loans. The somewhat ambiguous message perfectly shows the discord in which the financial sector finds itself.

After the fall of the American investment bank Lehman Brothers in September 2008, large financial institutions throughout the world experienced problems. At no time did the crisis that followed endanger the payment and settlement systems, however. Such systems act as intermediaries in financial transactions and guarantee that the buyer receives his financial products and the seller his money. In Belgium, international players such as SWIFT and Euroclear play a crucial role in this respect.

New financial landscape

However, the crisis did have an impact on the financial system. Various institutions, including several large Belgian ones, had to request support from the government in various forms to survive the storm. In those stormy times, financial institutions however continued to fulfil their role as financers of the economy. Both saving banks and large banks did this. Between the end of 2007 and September 2012, loans to companies increased by 19.8%, to families by 30.4% and to government bodies by 37.4%.

At the same time, the financial institutions worked on the reinforcement of their balance sheets (the total of their possessions or assets), for example by reducing their securities portfolios, reinforcing their financing from short to longer term and from market financing to deposit financing, or decreasing their leverage [1]. The reinforcement of the balance sheet is imposed via Basel III, the capital requirements as set by the Bank for International Settlements in Basel (BIS), an umbrella of the world’s central bankers. These rules, which were translated for Europe in the CRD IV Directive, provide that financial institutions must maintain more capital and liquidity in respect of their outstanding investments and loans. The rules will be gradually implemented from 2013 and must be fully in force in 2018.

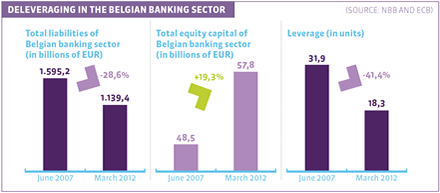

In Europe, the Belgian financial institutions have taken the lead to comply as quickly as possible with the Basel Accords: between the summer of 2007 and March 2012, the liabilities (the equity, part of which is the share capital, supplemented with borrowed capital such as saving deposits and debts on the interbank market) of the Belgian financial institutions has gone down by 28.6%. For that same period the hard basic equity (money that is available immediately, for example when losses would have to be accepted) increased by 19.3%. As a result, the leverage of the Belgian financial institutions dropped from 31.9 to 18.3. Financial institutions are therefore unmistakably more solid than before the crisis.

Due to the decrease in leverage, the banks also need less funding via the financial markets (wholesale funding). This is to the benefit of their liquidity position: banks have more money that is available to them immediately, due to which they experience fewer problems when they must fulfil various payment orders in the short term. Whereas in 2009 funding by the financial markets still amounted to €267 billion, this sum was reduced to 182 in 2011.

At the same time, the number of deposits is increasing. Traditionally, Belgians have always been savers. In the last few years, however, the amount deposited in saving accounts has increased spectacularly. In September 2012 there was a total of EUR 230.2 billion in Belgian savings accounts. Compared with end June 2007, this meant an increase of 54.7%. This deposit acquisition enables the financial institutions to provide cheaper loans and contributes to the stability of the Belgian financial institutions, in particular the savings banks. Financial markets, after all, are much more whimsical than savers. A larger share of saving deposits as compared to interbank debts increases the health of the banking balance sheets.

Future prospects

The challenge for the future will consist of reconciling the lower risk profile and the smaller scale of the Belgian financial sector with the demand for loans, which may increase strongly if the economy recovers. In this context, the question may be raised if the efforts to achieve banks that are as secure as possible and to achieve as little as possible risk will not nip economic growth in the bud (employment, lending, etc.).

The fact, also, that the Belgian financial institutions had no choice but to withdraw more within their national borders, could be a worrying issue in the future. This process of balkanisation or fragmentation of the European market, after all, could complicate lending to Belgian companies abroad.

Although the financial sector advocates the new regulations (such as Basel III) that increase the stability of the financial institutions and of the entire financial system, it also expresses its fear that the funding of long-term loan and loans for relatively large transactions and projects could become more difficult.

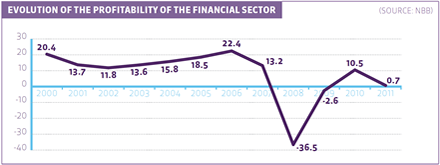

Within this changed financial landscape the financial institutions with their new and more restricted business models must nevertheless be able to continue generating sufficient profitability. The return on equity (ROE) of the Belgian financial institutions has dropped strongly since the crisis. The ROE divides the net profit by the equity of the company. The result shows the profitability of the company.

During the financial crisis of 2007-2008 the profitability of the financial sector dropped considerably. Just before the crisis, ROE levels were sometimes achieved that fluctuated around 20%.

At present, however, the financial sector is achieving an ROE of 0.7% (figure from end 2011). Naturally, this percentage cannot be maintained either. The sector must therefore look for the right balance, in which sustainable but viable ROE levels have a central place: a percentage around 8 or 12% would be an viable new normal.

[1] Leverage reflects the proportion between the equity of a financial institution and its balance sheet total. Deleverage means therefore the phasing-out of that leverage, for example by providing from the equity in proportion to the total balance sheet.