In various financial institutions, a “limiting” loan policy was developed. That means that additional CSR criteria are used to assess credit files of companies from the following sectors:

- producers of biological weapons, land mines, cluster bombs or weapons with depleted uranium

- weapon trade

- palm oil companies

- nuclear companies

- coal industry

- electricity industry

- etc.

Sectors or companies that practice corporate governance, are promoted. For example, the institutions support projects that promote the generation of renewable energy or green loans are placed on the market at lower rates and better conditions.

International

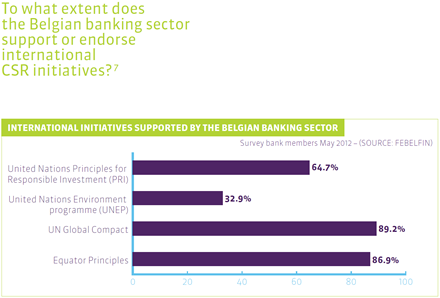

On an international level, various voluntary initiatives exist, such as the United Nations Global Compact or the UNEP (United Nations Environment Programme) Financial Initiative, two policy initiatives of the United Nations to promote socially responsible and environmentally-friendly enterprises. They also state guidelines for the funding of specific controversial sectors.

Only half of the surveyed institutions appear to have effectively signed one or more of these CSR initiatives effectively. Smaller institutions, in particular, dread the red tape this entails. However, this does not imply by definition that they do not comply with the CSR principles.